UPDATES - Options Strategy

29 Oct 2021 - Use Weekly TF for normal stock, all

26 Sep 2021 - Weekly Down Bar as a weekly RP retrace entry. So that i have the time to make entry. The only issue is lesser trades. To speed up the learning curve, i am starting to trade stocks, because the system can apply to all stocks so long it is an up trend market.

18 Sep 2021 - Using Weekly Bar as a standard for entry

With the currently level i had, i don't think it is good to trade stocks at the moment. I should focus on Indexes or ETF or stable futures where trend are in general up side.

My strategy is firstly based on (1) What to do if the system failed me? How to exit? (2) After that then how to enter for profit.

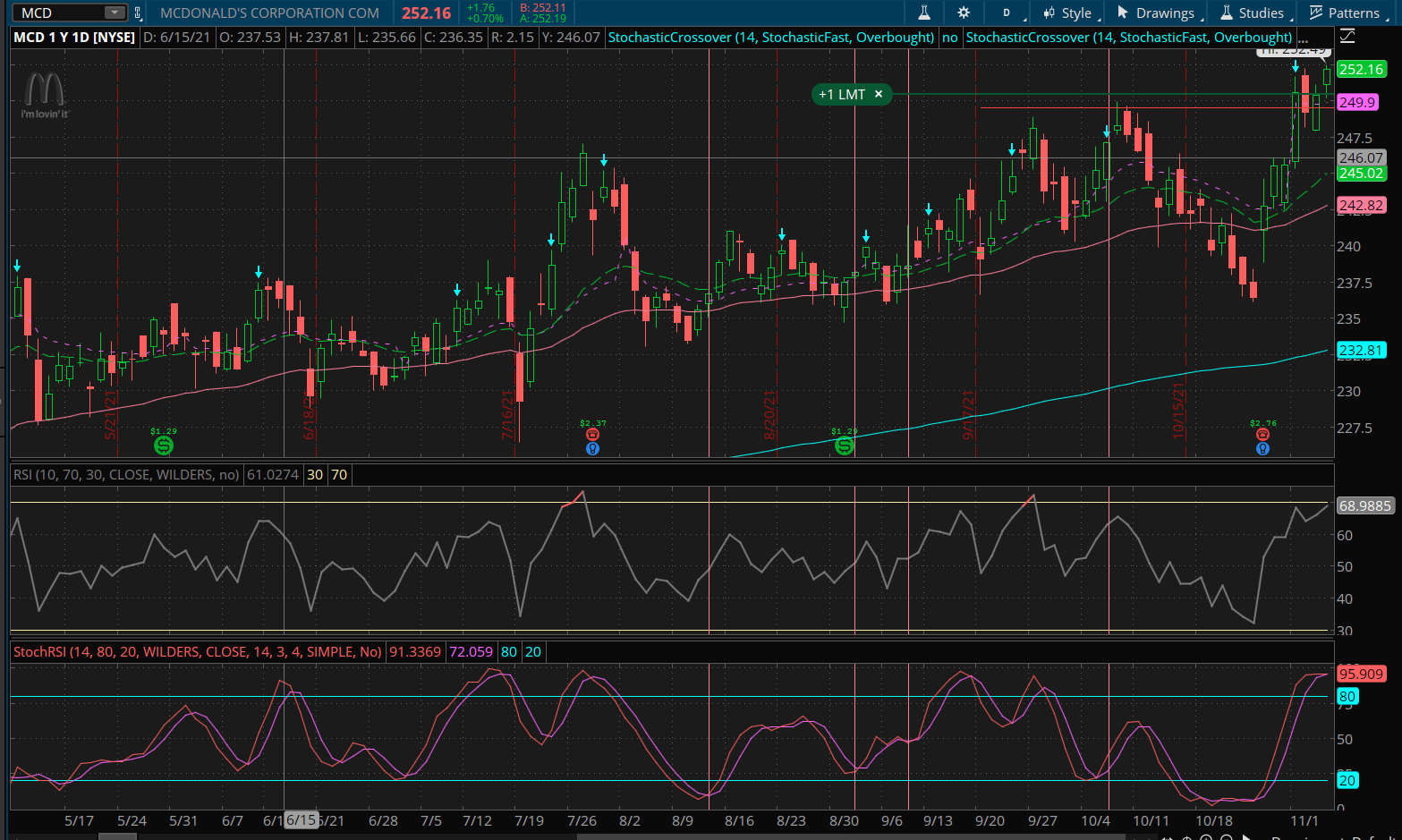

Weekly Bar entry : (1) be alert when you see a down weekly bar, (2) once the mkt hit 50ema and shows a TTM blue bar make a entry. (3) If the market is not good to you then wait till you see TTM bar turned blue then enter another order using (3a) If possible sell one vertical spread with 10 DTE but closing within the week using 5 day period only. (4) 1st order if not good and quite high, try to break even but if the mkt is near to 50ema then it should be close together with the 2nd order. (4) 2nd order should close within the week

Avoid: (1) RP top entry (2) you have to see Pink bar and then blue bar (3) Mkt must near EMA during entry. (4) When Stoch cycle is floating. (5) If weekly is congested e.g. RUT n

Profit & Exit : try to profit within 5 days if not exit.

Note: Mkae sure that TTM bar is blue and stay on or above EMA for up trend entry.

Apply to SPY + SPX + QQQ + /ES + /NQ + IWM

Okay -

Difficult - XLV (mkt too weak)

09 Sep 2021 - Focus on SPY - using mkt momentum + TTM + Diagonal strategy.

As suggested by Candy, i am trying out Diagonal using buy with higher delta and sell with lower delta.

05 Sep 2021 - TTM n STOCH Entry System

1) No Entry when Bar is pink colour + Squeeze ( RED or YELLOW) + Mkt below 200ema.

2) Few possible entry depending on situation:

a) Squeeze - Blue b) RP Top resistance c) Bar is Blue d) TL X up

e) Stoch is near 20

Ideal Entry : When Bar is non solid blue + Stoch is 20 or not 80 + Squeeze is Blue + above EMA. - Remember that you want to ride on momentum of market.

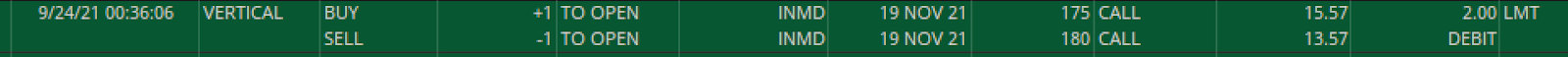

Little Adjustment - When spread is 5 dollars, the mid range is 2.50.

If more than 2.50 dollars then stay at ATM if less than 2.50 then move up to ITM.

28 Aug 2021 - I switch to H1 and H4 for mkt analysis so that i could read the chart patterns and setup.

15 Aug 2021

Do not enter buy when both H4 and Daily TF RSI is overbought.

Options - 7 Aug 2021

Directional – Up Trend Entry updates .

Fast Trend – Higher speed – Use H4 RSI/STOCH with VWAR and EMA

and TL support

Normal Trend – Moderate Speed – Use daily as above.

Ideally, enter while mkt is falling against you not

up. Because the premium is cheap and easier to TP.

Any stocks below 100 not considered.

Comments

Post a Comment