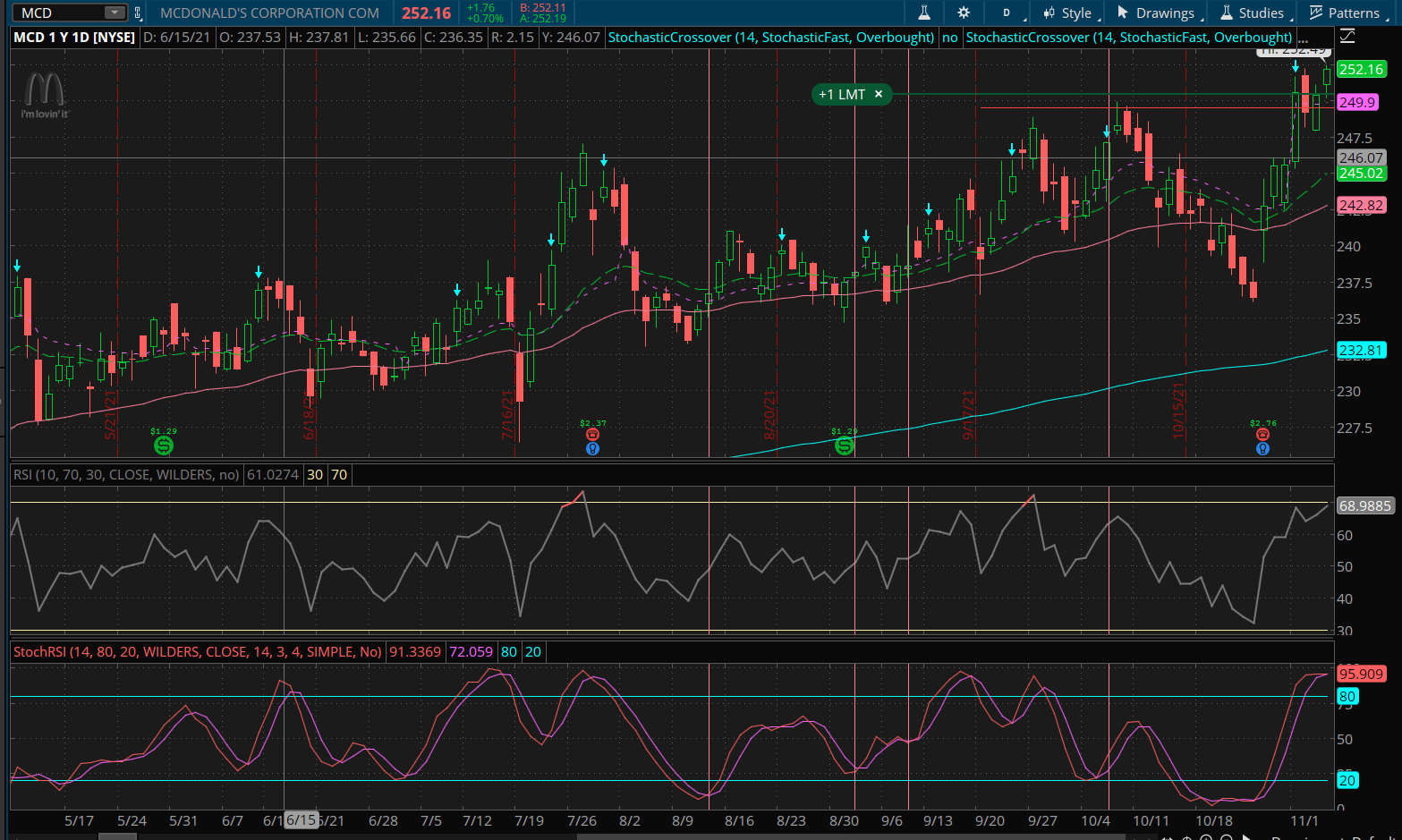

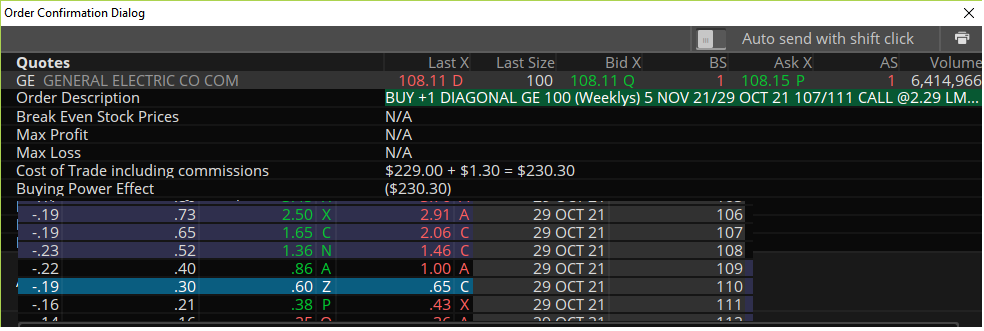

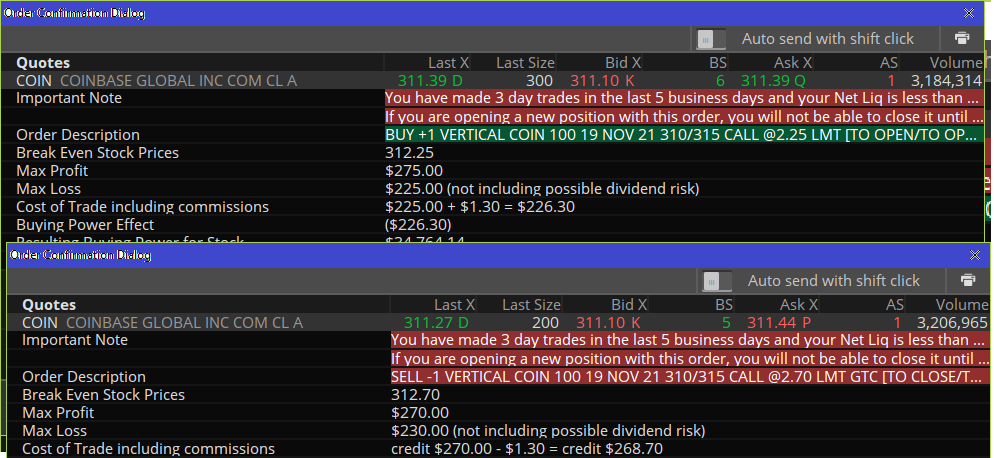

29 Oct 2021 - Use Weekly TF for normal stock, all 26 Sep 2021 - Weekly Down Bar as a weekly RP retrace entry. So that i have the time to make entry. The only issue is lesser trades. To speed up the learning curve, i am starting to trade stocks, because the system can apply to all stocks so long it is an up trend market. 18 Sep 2021 - Using Weekly Bar as a standard for entry With the currently level i had, i don't think it is good to trade stocks at the moment. I should focus on Indexes or ETF or stable futures where trend are in general up side. My strategy is firstly based on (1) What to do if the system failed me? How to exit? (2) After that then how to enter for profit. Weekly Bar entry : (1) be alert when you see a down weekly bar, (2) once the mkt hit 50ema and shows a TTM blue bar make a entry. (3) If the market is not good to you then wait till you see TTM bar turned blue then enter another order using (3a) If possible sell one vertical spread with 10 DTE but closi