Study - Options

25 Sep 2021 - 3rd Topics

Here's Why This Is the Best Indicator For Trading S&P 500

I posted my pre-open market comments in this sub today. You know from that post that I was looking to short a bounce. We got the move and the sell signal.

Two hours after the open I recorded a video with instructions on how to trade the remainder of the day.

Click this link to watch the video.

Here are the signals from 1OP. I told members NOT to trade the first buy. The second buy signal was at very least a scratch. The rest were incredible including the buy signal an hour before the close.

I won't share how it is calculated, but I do teach people how to trade it.

There are people who consistently make money day trading. You need a system.

25 Sep 2021- 2nd topics

How to Play the Current Market Drop

Several times this year SPY has broken through the lower end of its' upward sloping channel. On 1/29, 3/4, 6/18, 7/19 the price fell below the SMA 50 on the daily chart, and closed below it.

Each time SPY bounced back the following day, reestablishing the 50 as a major line of support for the ETF. After the next day closed above support, the market continued on to establish a new ATH.

Will that happen on Monday? We will soon find out, but I certainly hope it doesn't.

If SPY continues to drop, it will be the first time this year that a break of major support had continuation. At that point, 436 and 431.78 become the next two targets for a major breach.

Either way - do not anticipate a move, wait for confirmation before acting on it. In other words, don't start buying calls or going long on /ES futures thinking you can predict a bottom. You can't. It will become clear when SPY has established support and it's ready to rebound.

Here's what you should be doing though - making your list of stocks that are gaining strength ahead of SPY. Stocks like UPST, ETSY, and DASH have all been pushing upwards during this market decline. The next list should be of stocks that that are currently holding major support areas (MSFT, FB, and AMZN for example) - these stocks have been dragged down by a bearish market trend, but also have been able to hold support (unlike AAPL which broke through).

When SPY finally does finds support, this is your opportunity for some high probability trades. An opportunity you do not want to waste by trying to get ahead of it.

This means that the first thing you will need to do is, be patient. This is much harder to do than it sounds of course. You'll see SPY bouncing back up and watching the stocks on your list bounce up with it. At this point you might think, "I am missing it, I need to get in now!". No you don't. Wait. Make sure the market isn't just chopping around, and then getting ready for another leg down. Much like it did from Monday - Thursday of last week.

When the market finally begins to reverse it will be clear - and it is at this point you want to start putting on Put Credit Spreads, Call Debit Spreads, Straight Calls, and Long Stock among those tickers you have been watching. For example - let's say the market continues to drop and heads down to 431 (SMA 100), where it stabilizes and then begins to bounce back upwards. At the same point you notice that AMZN is resting on it's SMA 100 around 3400. As the market starts to go back up, so will AMZN, most likely recapturing its SMA 50 (3450). You could do a Put Credit Spread of 3395/3390 for 3 weeks out and probably get a credit of roughly $1.50 for it, which is a 43% ROI. You'll have two major lines of support above your short strike, giving you a lot of cushion on this trade. You could also do a Call Debit Spread ATM of 3455/3460 for a debit under $2.50, as well. Your risk is defined by your debit, which is less than 50% of the distance in the strike prices.

Perhaps MSFT dropped down to $292, right on its SMA 50, and is also showing Relative Strength to SPY - if so you can do a one month out ITM calls with a delta of .7 or higher (probably a strike around $270).

Make sure you aren't too heavy into any single sector, and you have stocks like MCD and AMAT in your list as well.

What you want is to have several bullish plays ready to go across various sectors, and when you see SPY once again push upwards, you should be aggressively pulling the trigger on these trades. Again - not until you have confirmed that SPY has found support.

Drops like these provide the best buying opportunities but so often people are either unprepared for them or jump in too early. Last Thursday (9/16), I saw many traders assume that the drop was over given the previous pattern on SPY and as such they started executing a number of bullish swing trades, including Calls on SPY. Needless to say, on Friday their accounts took a serious hit. Why? Because SPY did not confirm a reversal, just consolidation.

There are several areas of horizontal support/resistance for SPY, downward sloping trendlines you can draw on the daily chart, and major SMA's to guide you - it should not be unclear to anyone when SPY reverses. On Thursday, the market breached none of these lines - so there was no reason to get bullish on it.

Obviously these drops provide excellent Day Trading opportunities - on Friday for example, ZM began to go up around noon (est) as SPY continued to chop around, indicating Relative Strength to the market. At 2pm (est), that strength is confirmed with SPY dropping and ZM holding its' bid. That ticker provided several excellent Day Trading entries and exits throughout the day. UPST and ETSY were similar. In fact, days that SPY is bearish give you the best insight into stocks that are strong against the market and ready to really go once that get a tailwind behind them.

Many short-term traders shy away from price action like this on SPY and that would be a mistake. Day Trade these drops with strong stocks, Swing Trade the reversal with high probability option plays.

*Obviously you can and should Day Trade the reversal as well, but that is just a matter of looking for RS/RW as SPY is rebounding.

**Also note that when I refer to Relative Strength I am not talking about RSI or Beta. There are several posts on RS/RW in r/RealDayTrading and in my post history if you are curious.

TL;DR - These market drops provide the best swing and day trading opportunities, don't let them pass you by.

25 Sep 2021 - Using SPY as a reference and compare with stock using 5m, they should be in line with each other. https://www.reddit.com/r/RealDayTrading/comments/or3o22/using_debit_spreads_a_profitable_day_trading/

Using Debit Spreads a profitable day trading Strategy

Many traders trade debit spreads but generally using expiration dates a few weeks or more in the future.

There is a very effective strategy for trading debit spreads using the current weeks expiration.

There are just a few criteria that need to be followed to make the debit spreads a profitable strategy for day trading.

For call debit spreads the stock selected must have relative strength versus the SPY on a 5 min basis (this is not RSI but a stock that outperforming the SPY index on a 5 min basis)

Stock should be bullish technically on the daily chart

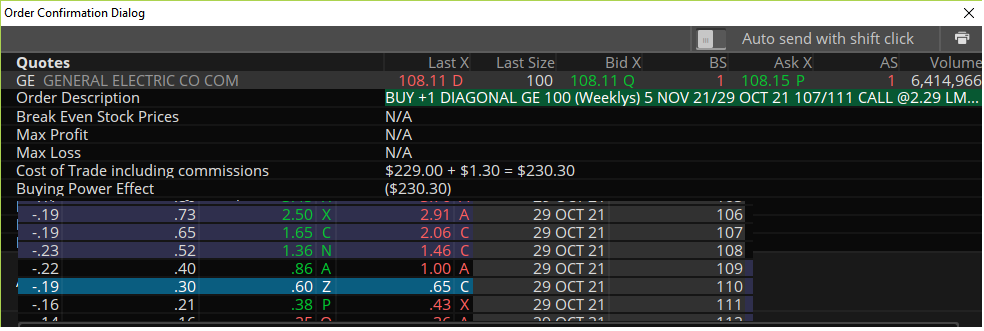

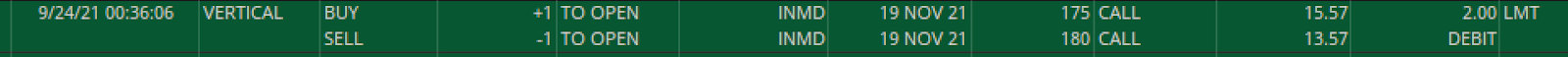

Buy a call close to at the money or slightly in the money and sell a higher strike call and the spread MUST be purchased for less than 50% of the spread. IE a spread with a $5 spread should be bought for less than $2.50 per spread contract, the lower the better.

Immediately place a sell order for a profit of from 10% to 50% depending on the number of days to expiration. On monday and tuesday 10% to 20% is reasonable and scale the profit target up the closer to friday the trade is put on.

This strategy can be used on some stocks with fairly wide bid ask spreads (such as AMZN GOOGL TSLA etc)

Because of the structure of the spread the downside risk is mitigated by having a short call that will time decay faster than the long call thus a sideways move will reduce the premium on the short call faster than on the long call. Because of this it allows you to stay in the trade longer than if you were using straight calls.

You are capping your profits if the stock goes parabolic but this s more than offset by the % of times you will be profitable on marginal stock moves.

Put debit spreads work the same except for the stock setup has to be bearish

If you try this strategy use 1 or 2 contracts until you are comfortable with the strategy.

Remember, to be a successful and consistently profitable trader you need to have several strategies in your tool belt and must always be aware of the market movement at all times and use that as a guide as to when to enter any strategy you use.

08Sep2021 - Poor Man Covered Call

If you are long term bullish on a stock.

Comments

Post a Comment