Forex: Post Thanksgiving Breakout?

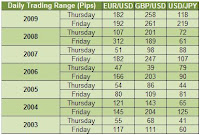

The table below shows that for the EUR/USD, GBP/USD and USD/JPY (the three most actively traded currencies), the trading range on Thanksgiving Day is usually very narrow. Between 2005 and 2007, the range between the high and low in the EUR/USD was no more than 55 pips. When the financial crisis hit in 2008, trading ranges expanded and have remained wide since then. However one pattern that has been fairly consistent is the risk of big move on the Friday after Thanksgiving.

In 2003, the daily trading range of the EUR/USD and GBP/USD tripled on Friday but in 2004 and 2005 for example, the trading range only expanded slightly. In 2006 and 2007, we saw a breakout once against in both currencies but in 2008, only the EUR/USD saw an expanded range. The GBP/USD, which already had a big move on Thursday, maintained its volatility on Friday. In 2009, the EUR/USD and GBP/USD had a big move on both days. So based upon how these currencies traded over the past 7 years, the Friday after Thanksgiving is rarely a boring one. Even though there are no major economic reports on calendar, thin volatility could lead to a breakout or expanded trading range. Interestingly e

Tnough USD/JPY typically does not move much on either day and that may be due to the fact that most of the volatility is contained within European trading hours.

Traders can gain beneficial information by exploring posts like these.To manage risk and returns in a better way learning about market is must. To learn live updates on stock market follow epic research .

ReplyDelete